Roche and Carmot's GLP1 pipeline

We take a look at Roche (via Carmot)'s GLP1 pipeline development, and figure out how CT-388, CT-996, and CT-868 are trending.

Roche is a large multi-national pharmaceutical company that's well known for a huge number of new drug discoveries (one of the most popular being Accutane for acne).

Roche entered the GLP1 Receptor Agonist marketplace with their acquisition of Carmot (a US company based out of Berkeley, California) at the end of 2023:

At the time, Carmot's lead drug was a GLP1 + GIP dual agonist (similar to but not the same as Tirzepatide AKA Mounjaro/Zepbound) called CT-388.

Want to know how drugs like Ozempic, Mounjaro, Wegovy, or Zepbound actually work?

Check out our quick explainer

Roche acquired Carmot specifically for it's "clinical stage incretins [with] great potential to treat obesity, diabetes and potentially other diseases" – a smart move given how huge GLP1s look to be to the future of obesity and healthcare worldwide in general.

That said, CT-388 wasn't alone – there were two other drugs in focus:

- CT-996 is a once-daily oral pill, and a "simple" GLP1 receptor agonist (single agonist)

- CT-868 was a subcutaneous injection of a dual agonist (GLP + GIP) that was aimed towards sufferers of type 1 diabetes who are overweight or suffering from obesity.

When Roche purchased Carmot, it had already shown great results in phase 1B trials, which made the rounds, achieving 8% weight loss in 4 weeks:

(Unfortunately Carmot has since updated the page where it announced it's results, so you have to use a resource like The Internet Archive to find the page. the findings were also celebrated in Diabetes research journal)

Things have changed since then, but we're going to take a look at what Roche and Carmot have developed, and how it's progressing so far.

What is CT-388?

As mentioned earlier (for those skimming), CT-388 is a dual agonist of GLP1 and GIP – it interacts with two hormones that naturally occur in the body, and importantly (at least in the case of GLP1) it suppresses appetite (and often what might be addictive behavior) in the brain.

This drug is similar to Tirzepatide, and while that does not guarantee that results will be similarly spectacular (Tirzepatide is the most effective FDA approved GLP1 at this point), they have promised to be similar so far.

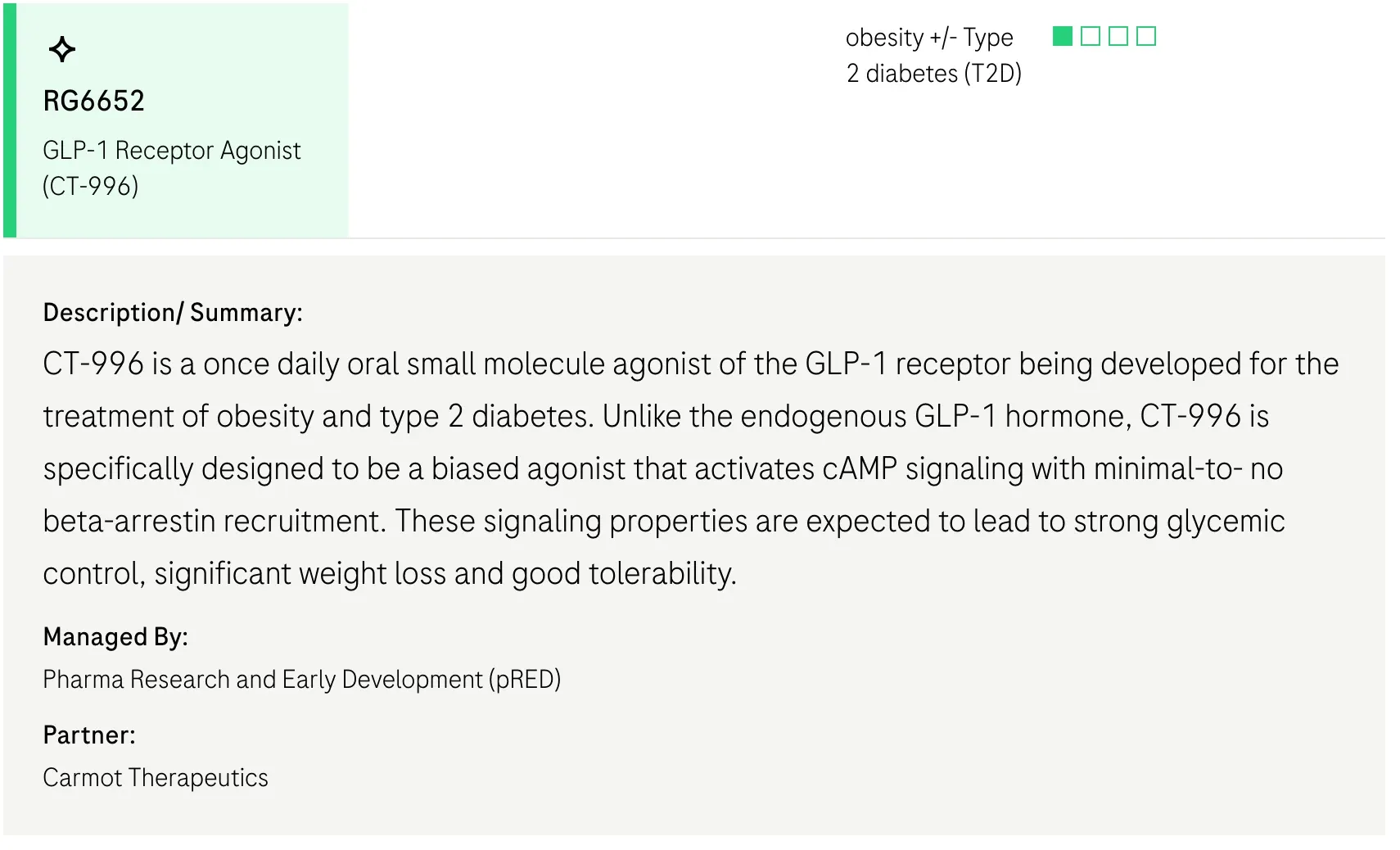

What is CT-996?

CT-996, unlike CT-388 is a single agonist that targets the GLP1 receptor, that is meant to be taken orally, once a day.

This is similar to medications like Rybelsus:

And more recently Eli Lilly's Orforglipron:

As is probably obvious, being able to take a GLP1 orally and achieve significant results is a game-changer:

- More sustainable distribution (no more injection pens)

- More convenient user experience

- Easier manufacturing and logistics

Importantly, the differences between CT-996 and others mean that approvals will likely be separate, it is not simply a reformulation of CT-388.

What is CT-868?

CT-868 is covered much less than the other drugs in the Carmot (now Roche) pipeline, but is valuable nonetheless to people who are struggling with type 1 diabetes and obesity.

CT-868 was also in clinical trials way back in 2023, so it's quite far along in the process and a viable candidate going forward.

2024: Industry-leading results for the injectable CT-388 dual agonist

Roche made headlines in 2024 announcing positive results from Phase 1B trials for CT-388:

Over 24 weeks, a once-weekly subcutaneous injection of CT-388 achieved a clinically meaningful and statistically significant mean placebo-adjusted weight loss of 18.8% (p < 0.001)

18.8% in 24 weeks is an insane amount of weight loss (likely high enough to trigger other issues like gallstones which might be a worry).

What's even better is that these results were achieved with similar negative side effects as other GLP1s – there does not seem to be any added danger from the drug itself compared to it's widely-taken peers.

2024: Great stage results for oral single agonist CT-996

Reports surfaced of early results for CT-996:

The data revealed a loss of 6% more body weight than placebo when using the oral form (CT-996):

The new results are from a phase 1 trial of a once-daily pill called CT-966, which revealed an average weight loss of 7.3% at four weeks in the study population of obese patients without diabetes, compared to a 1.2% reduction with placebo.

This is quite impressive in both terms of time frame and the efficacy of a GLP1 receptor agonist in pill form.

For contrast, Rybelsus which in the past took over 26 weeks to show changes to body weight in early studies, and reported 3-4kg losses after a year in later studies.

2025: Roche is also working with Zealand Pharma on Petrelintide, an Amylin based weight loss drug

Roche is also working on another approach with the help of Zealand Pharma:

This shows that Roche is clearly committed to GLP1s for weight loss, and importantly is taking a multiple paths to get there.

More importantly, Roche is exploring combining petrelintide with CT-388 in order to boost it's effectiveness and tolerability.

The combination of petrelintide with Roche’s dual GLP-1/GIP receptor agonist CT-388 will further strengthen and expand Roche’s pipeline in the field of cardiovascular, renal, and metabolic (CVRM) diseases. This combination offers the opportunity for best-in-disease efficacy while potentially offering enhanced tolerability.

On the less rosy side, this may signal that there was a problem with the side effects that CT-388 caused.

Roche commits 50 Billion to US manufacturing

With the recent moves of the Trump Administration in creating Tariffs and trying to spur US investment, Roche has taken the extraordinary move of investing 50 billion USD over the next 5 years:

While it's not clear these investments will stay the course/be evenly applied after the Trump administration leaves office, clearly Roche is serious about the US market.

To be clear, Roche already had significant US investment with many R&D centers and manufacturing sites in the US.

So when will any of Roche's drug enter the marketplace?

Unfortunately, Roche's most advanced drug, CT-388, is slated to be filed for in 2028:

This is a long time to wait for a new GLP1 to hit the market, and while results have been spectacular, it shows that there will be a large amount of time until this new GLP1 enters the market.

So how about CT-996?

As you might have imagined, it's even further behind, with no projected filing date.

Last but not least, CT-868:

CT-868 is on a similar trajectory with CT-388, and at least has a projected filing date, though it is further in the future than CT-388.

These new GLP1 receptor agonists are incredibly impressive, but it's important to realize how long it will take until humanity can benefit from their innovations, even in a perfect scenario (assuming no new negative side effects are discovered).